You may be wondering why you need vacation rental insurance if you already have a homeowners policy in place, as well as protection like AirCover for Hosts. Also, you might have doubts over what is and isn’t typically included in property management insurance for short-term rentals (STRs).

In this article, we’ll walk you through the key benefits of having a separate insurance policy for your STR business, plus explain what vacation rental insurance does and doesn’t normally cover.

You’ll see examples of dedicated STR insurance solutions and learn about other ways to add protection to your units and business as a whole—which is beneficial to you, your homeowner clients, and your guests.

.png)

Most homeowner insurance policies don’t provide cover for properties that are being used for commercial purposes. So, if one of your vacation rentals suffers structural damage (or damage to any of its contents) during a guest stay, any protection that the homeowner has is unlikely to be valid. Therefore, for reservations taken from your direct booking site, the vacation rental and its contents will be unprotected.

Meanwhile, though some of the online travel agencies (OTAs) where you list might provide some form of protection, usually their primary focus is to provide a positive user experience to guests. As a result, they aren’t specialized in processing claims or managing disputes, and they often don’t pay out unless the guest accepts liability.

Specialist STR insurance fills the gap: It provides the protection that typical homeowner insurance doesn’t, and it’s designed to process claims fast, often even when the guest doesn’t accept liability for the damage they caused.

As we’ll see, this doesn't only have implications for home and contents coverage—guests, homeowners, and STR property managers and their businesses can all enjoy peace of mind from vacation rental insurance that they’d otherwise be without. This includes:

STR insurance providers tend to provide coverage for the same kinds of risks with similar limitations. Below we look at what they generally do and don’t protect you for.

Here are some of the areas where vacation rental insurance provides protection for you, the homeowner, and guest:

Here are some areas where vacation rental insurance doesn’t typically protect you, the homeowner, or guest:

There are plenty of vacation rental insurance providers you can research and choose between. To help get you started, here’s a short selection of notable services (ordered alphabetically):

Vacation rental insurance can be an important asset in protecting you, your business, and your customers, but you don’t have to stop there in your efforts to keep your properties safe. These insurance policies are especially valuable when used in combination with these other short-term rental solutions.

Manually guest screening guests is inefficient, not scalable, and could even bring about accusations of discrimination. Tools like Autohost, Safely, and Superhog run non-invasive checks on guests so you can make an informed choice on whether to proceed with a booking.

This provides you with an extra layer of protection and can be a reassuring feature of your service to homeowners.

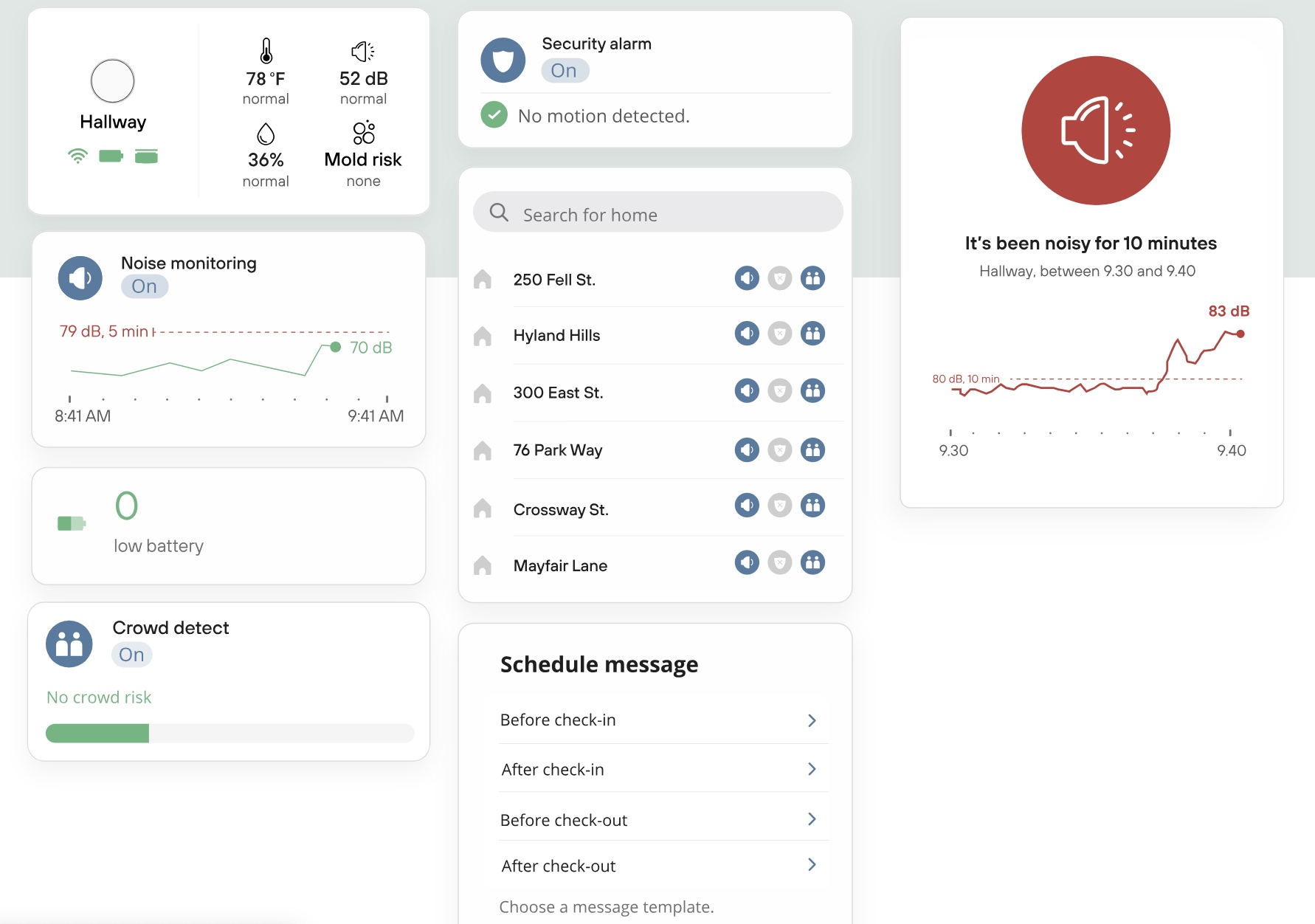

Vacation rental noise monitoring provides you with a privacy-safe way to:

With Minut’s standalone sensor and mobile app, you’ll have access to a historical log of reporting on noise that you can use as evidence in a dispute. Also, you can use Minut to automate guest messages to request that they keep the noise down if you receive an alert.

Guests smoking in your units can cause extensive damage and result in costly cleaning that cuts into your profits. But despite it creating issues for homeowners and future guests, it’s very difficult to prove.

A vacation rental smoke detector alerts you to cigarette smoke as soon as it's detected and provides you with evidence you can use in a claim.

Minut’s cigarette smoke detection for STRs is easy to set up (you simply activate it using the toggle in the app), and you can use it as a compelling selling point to prospective property owner clients.

Vacation rental occupancy monitoring helps you minimize the risk of property damage from a stay that got out of hand. It also provides reassurance to homeowners that their properties and belongings are safe, plus helps you stay compliant with local STR laws.

With Minut’s crowd control, you can customize the maximum occupancy per unit, which the software reports on in real-time by analyzing the number of personal devices present within a property.

Alongside Minut’s other features, like noise monitoring, cigarette smoke detection, temperature and humidity monitoring, window breakage detection, and alarm detection, this gives you visibility across your entire portfolio and the ability to manage property protection from a user-friendly mobile app.

.png)

Most homeowner insurance policies aren’t valid for homes when used as vacation rentals, and the protection provided by many OTA platforms doesn’t match the comprehensive coverage or service of a dedicated STR insurance provider.

At the same time, there are inherent risks to managing vacation rentals that mean you could suddenly be liable for an accident or have to take on the costs of damaged or lost items, which adds up over time. With STR insurance coverage, though, you can be protected against many of those risks.

To further strengthen your protection—and to build greater trust with your homeowners and guests—you should consider scalable solutions like automated guest screening and a home protection device like Minut, which monitors noise, occupancy, cigarette smoking, and more.

.png)