As of 2025, Denver is one of the strictest short-term rental (STR) markets in the United States, and the rules are enforced with real teeth. If you’re operating in the Mile High City, or advising owners who are, this guide distills what you need to know to stay compliant and protect your business under current Denver short-term rental laws.

Short-term rentals in Denver are legal only if the host lives in the property as their full-time primary residence and obtains the required city licenses.

That single sentence captures the heart of Denver’s policy. From licensing and taxes to safety inspections and advertising rules, the city has built a system designed to preserve neighborhood stability while accommodating responsible hosting. The good news: when you understand the framework, you can operate confidently and proactively, simultaneously protecting your guests, your properties, and your brand.

To ground the guidance below, we reference the city’s current rules and FAQs, 2025 noise ordinance updates, and recent enforcement and market data. You’ll see links to official pages throughout for quick verification and deeper reading.

Denver defines a short-term rental as lodging for fewer than 30 consecutive days. STRs are treated as an accessory use of a dwelling that is also a host’s primary residence. The city is explicit: you can have only one primary residence, and you must actually live there.

Owners and tenants can operate STRs in Denver, but both must meet the same licensing and compliance standards, and tenants also need written permission from their landlord. The City’s STR license hub explains that a license is needed “if you rent a property to guests for fewer than 29 nights at one time” and that a primary residence is “the place in which a person’s habitation is fixed for the term of the license and is the person’s usual place of return. A person can have only one primary residence.”

For any stay under 30 nights, licensing is non-negotiable. Denver’s processes are thorough and timelines matter when you’re planning go-live dates or renewals.

Anyone offering stays of fewer than 30 days within the city limits must hold an STR business license tied to the property that is their primary residence. This applies across single-family homes, condos, apartments, and eligible accessory dwelling units (ADUs), subject to zoning and HOA constraints. The City’s core requirements are clarified further in the Short-term rental FAQ.

As of 2025, the City generally reviews initial STR applications within 30 days, and specialist reviews can take up to 90 days. Processing times can fluctuate, so always check the portal for current estimates. Annual renewals are required, and licensees must update contact details promptly whenever they change. You must display your license number on every advertisement, including Airbnb and Vrbo. For current processing guidance and advertising requirements, consult the City’s official short-term rentals FAQs page.

Expect to provide evidence that the address is your primary residence, along with key safety, tax, and ownership or occupancy documents. In practice, applications often include the following, but remember that these requirements may change in the future so always check official documentation before making a decision:

The 2019 rules also state that although HOA or condo approval is not uploaded in every case, you must obtain and retain it when governing documents prohibit or restrict STR activity. The City can request it during review or enforcement.

Primary residence is the cornerstone of Denver’s STR policy. The City uses multiple indicators to verify the claim, including but not limited to:

Only the host’s primary residence is eligible for a standard STR license, and the City has shown a willingness to revoke licenses when primary residence is misrepresented. If you want to rent a non-primary unit, you need a lodging facility license, but it’s important to note that only certain zone districts can have lodging facilities, and it might be necessary for a change of building occupancy classification.

Life-safety readiness is as important as your paperwork. The City requires working smoke alarms, carbon monoxide detectors where required by code, a fire extinguisher, clear emergency exit instructions, and an accurate floor plan indicating safety equipment. Inspections may occur randomly, during complaint investigations, or as part of specialist reviews.

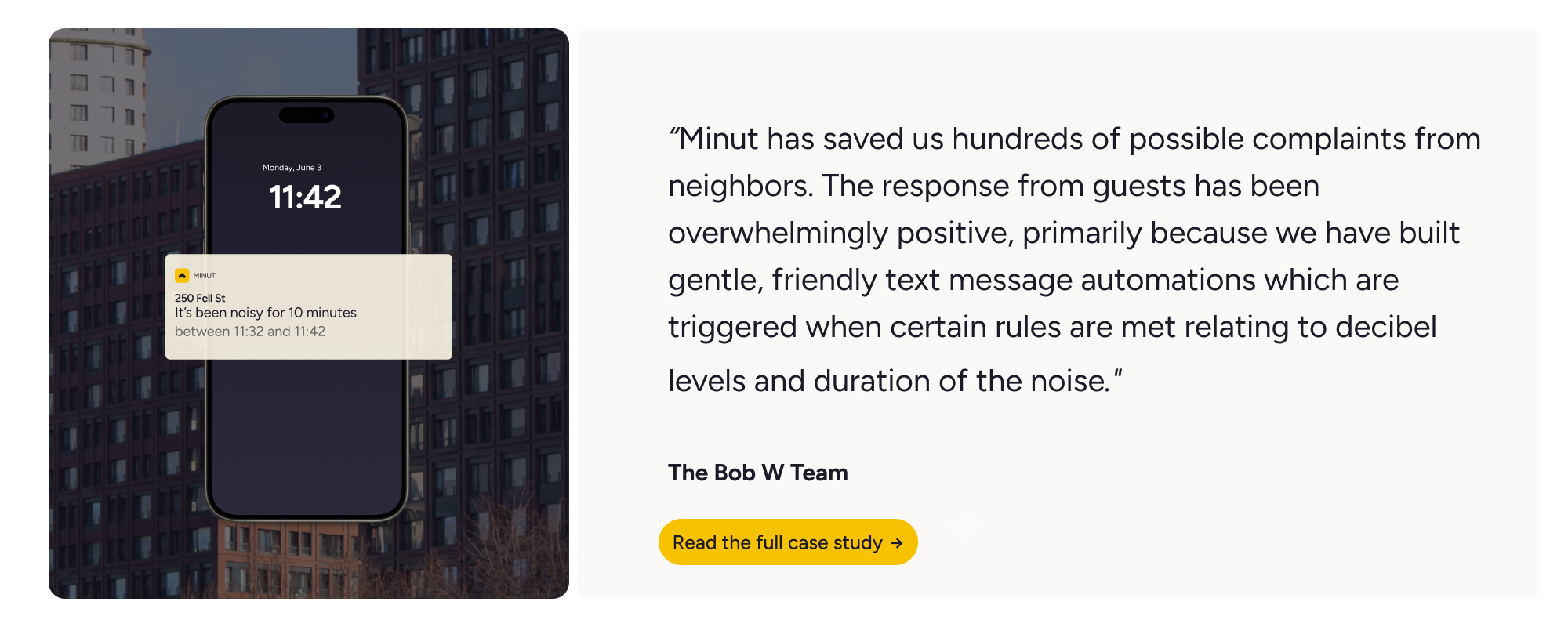

In 2025, Denver modernized its citywide noise ordinance. Typical residential limits are 55 dBA from 7 a.m. to 10 p.m. and 50 dBA overnight, and violations can trigger enforcement by the Department of Public Health & Environment or police.

STRs must rent to a single party at a time and cannot host events such as weddings, fund raisers, or similar gatherings. These limitations are codified in the Denver Zoning Code Interpretation.

If you’re looking for a privacy-safe way to stay ahead of noise issues while protecting guest trust, see our article on how non-invasive decibel monitoring helps you enforce rules and comply with regulations.

Denver STRs are subject to multiple layers of taxes that may be collected by the platform or must be remitted by you. The City’s Treasury guidance puts the responsibility on operators to ensure taxes are registered and paid correctly.

As of 2025, Denver’s Lodger’s Tax rate is 10.75% and applies to lodging under 30 days. It’s charged on the total price including rent and applicable fees and must be collected at the time of sale. STR operators must establish and maintain a Lodger’s Tax account with the City.

The same guidance notes the City’s Occupational Privilege Tax (OPT) for business activity within Denver. Hotels with 50 or more rooms also owe an additional 1% Tourism Improvement District (TID) tax. While that specific surcharge targets large hotels rather than STRs, it illustrates how lodging-related tax layers can vary by asset type.

Colorado state and special district taxes can apply to STRs, and rates vary by location and component. Platforms may not always collect every applicable tax on your behalf. The City emphasizes that hosts remain responsible for Lodger’s Tax registration and remittance where a platform does not collect.

Denver pairs strict licensing with equally strict advertising and on-site requirements. The Short-term rental FAQs state that you must:

Hosts don’t need to be physically present during guest stays, provided the contact, brochure, and responsible-party requirements are met.

Running a lawful STR in Denver requires getting the fundamentals right and keeping them up to date. At a minimum, you should have:

For noise and house rule enforcement, privacy-safe monitoring can help you resolve issues before they escalate.

Denver short-term rental laws are clear and consistently enforced. To operate legally, you must live in the STR as your primary residence, secure the STR license and a Lodger’s Tax account, meet safety and insurance requirements, and follow strict advertising and operational rules. The City’s timelines, tax obligations, and 2025 noise standards make proactive, privacy-forward operations essential. When you combine meticulous compliance with smart guest communication and noise prevention, you protect your reputation, your neighbors, and your revenue.

No. Only a host’s primary residence is eligible for an STR license in Denver. Non-primary residences seeking nightly operations may require a lodging facility license in a permitted zone district.

Yes, but tenants must meet all licensing and safety requirements and obtain a landlord permission affidavit.

Sometimes. Denver emphasizes that platforms may not collect every applicable tax for you. You must maintain a Lodger’s Tax account and remit when required.

Yes. STR rules require you to notify your insurer and maintain at least $1,000,000 aggregate liability coverage or conduct each transaction through a platform with equivalent coverage.

Denver’s 2025 noise ordinance sets typical residential limits at 55 dBA by day and 50 dBA at night. STRs cannot be used for events and must rent to a single party at a time.

This guide is provided for informational purposes only and does not constitute legal or tax advice. Regulations and tax rates change, and enforcement practices evolve. Always consult the City and County of Denver’s official resources and your legal or tax advisor before making operational decisions.